Unleashing the Power of Dave Ramsey's Baby Step 4: Save 15% for Retirement ASAP

This is a subtitle for your new post

Are you dreaming of a comfortable retirement? It's time to harness the power of Dave Ramsey's Baby Step 4, saving 15% of your income towards retirement. You can ensure a financial security future and enjoy peace of mind. This article will explore the benefits of starting early, the magic of compound interest, and how to make the most of your savings journey.

The Earlier, The Better:

The key to success in Baby Step 4 is to start saving for retirement as soon as possible. By beginning your savings journey early in your career, you'll reap the benefits of time and compound interest, making it much easier to reach your financial goals. This approach offers several advantages:

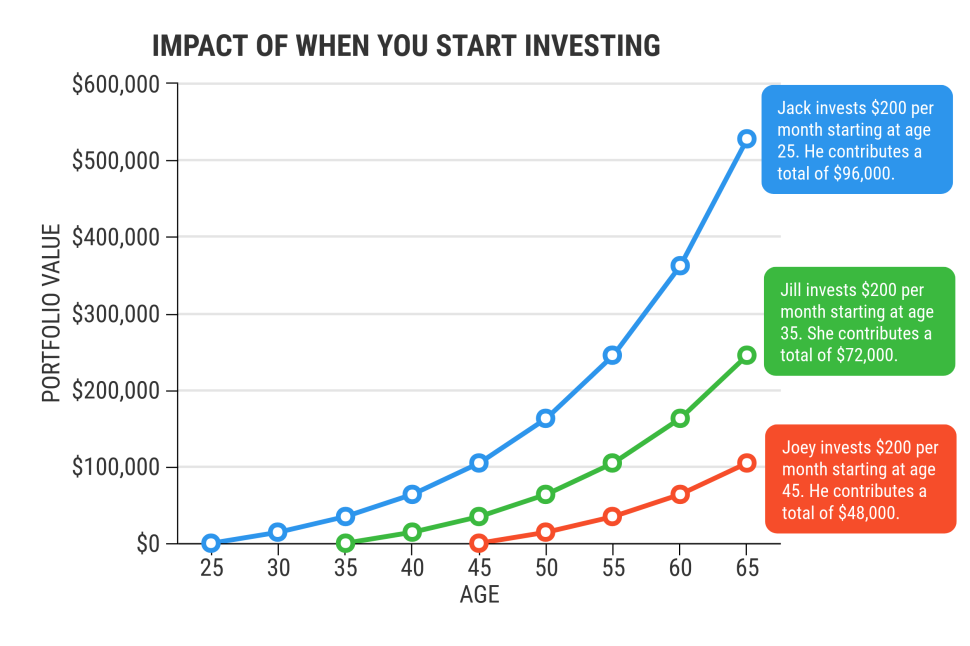

- More time to save: The sooner you start, the more time you have to build your nest egg. This means you can save less each month but still save more money in the long run.

- More time for investments to grow: When you invest early, you give your money more time to grow and benefit from the power of compound interest. This can significantly increase your retirement fund.

- Financial security: Saving consistently throughout your career helps you develop good financial habits and reduces the risk of financial insecurity in your golden years.

Compound Interest: Your Secret Weapon

Compound interest is the key to unlocking the full potential of Baby Step 4. When you invest your savings, you earn interest on both the principal amount and the already earned interest. Your money grows exponentially over time, making it a powerful ally in your retirement savings journey.

For example, if you start saving 15% of a $50,000 salary at age 25 and invest it at an average annual return of 7%, by the time you reach 65, you'll have amassed over $1.4 million. However, if you wait until age 35 to save the same percentage, you'll have just under $750,000. The difference is staggering, and it all comes down to the power of compound interest.

Figure 1 - Reprinted from US News and World Report - https://money.usnews.com/investing/investing-101/articles/2018-07-23/9-charts-showing-why-you-should-invest-today

Maximizing Baby Step 4:

To get the most out of Dave Ramsey's Baby Step 4, follow these tips:

- Make it automatic: Set up automatic transfers from your paycheck to your retirement account to ensure you save 15% of your income consistently.

- Diversify your investments: Spread your savings across a mix of stocks, bonds, and other assets to reduce risk and optimize returns.

- Stay the course: Stay committed to your long-term financial goals, even during market fluctuations. Remember that time is on your side.

- Periodically reevaluate: Adjust your savings strategy accordingly as your financial situation evolves.

Conclusion:

Dave Ramsey's Baby Step 4 is a powerful tool for securing your financial future. By saving 15% of your income for retirement as soon as possible, you can harness the power of compound interest and build a substantial nest egg. Don't delay – start your savings journey today and enjoy the peace of mind that comes with financial security in retirement.

Jeff Kikel, ChFC, CRPC, ASBC, NQPA is the President and Founder of Freedom Day Wealth Management LLC, a Registered Investment Advisor based in Cedar Park, TX. Jeff is a 30 year financial industry veteran with expertise working with Familes, Self Employed Individuals and Business Owners. Jeff is the creator of the Freedom Day Method (tm) which helps his clients reach a work optional lifestyle as quickly as possible. When not working with clients you will find Jeff working on his two YouTube Shows, Freedom Nation and The Cents of Things or checking things off of his Bucket List. Jeff is the author of 6 books with the 7th, Freedom Day: Quit the Job you Hate, Live the Life You Love coming out in Spring of 2023.